Defending Families from Bank-breaking College Costs — and Guiding

Students to Smart Choices

With the Superhero of College

Planning on your side, you’ll navigate the college admissions process with

confidence, avoid costly mistakes, and

save thousands — all while finding the

right-fit college for your teen.

Book a free consultation to learn how we use our proven 3-step process to build a personalized college admissions strategy for your family..

Not ready for a consultation?

Download our free College Planning Guide.

🎓 Trusted by Over 1,200 Families Nationwide

💰 $25+ Million in Scholarships Earned

🧭 98% Acceptance Rate to Right-Fit Colleges

⏳ 20 Years of Trusted Guidance

🎉 Class of 2029 Results at a Glance 🎉

215+ College Acceptances

Vanderbilt, Olin School of Engineering, Georgia Tech, Univ. of Florida, Chapel Hill, Univ. of Michigan, and more

You’re Not Alone

Most parents feel anxious about college planning:

Rising costs

Complicated applications

Increased Competition

Pressure to make the right choice

At Clark College Consulting, we understand how overwhelming it feels.

Every great hero needs a guide—and with the right plan, you can protect your family's financial future while launching your teen toward theirs.

Watch the video below to learn more!👇

I don’t wear a cape or have x-ray vision, but I do have a superpower – and it’s helping families with college-bound teens transform their futures. But the families I work with? They’re the true Superheroes.

Learn how to become the Superhero of your family!

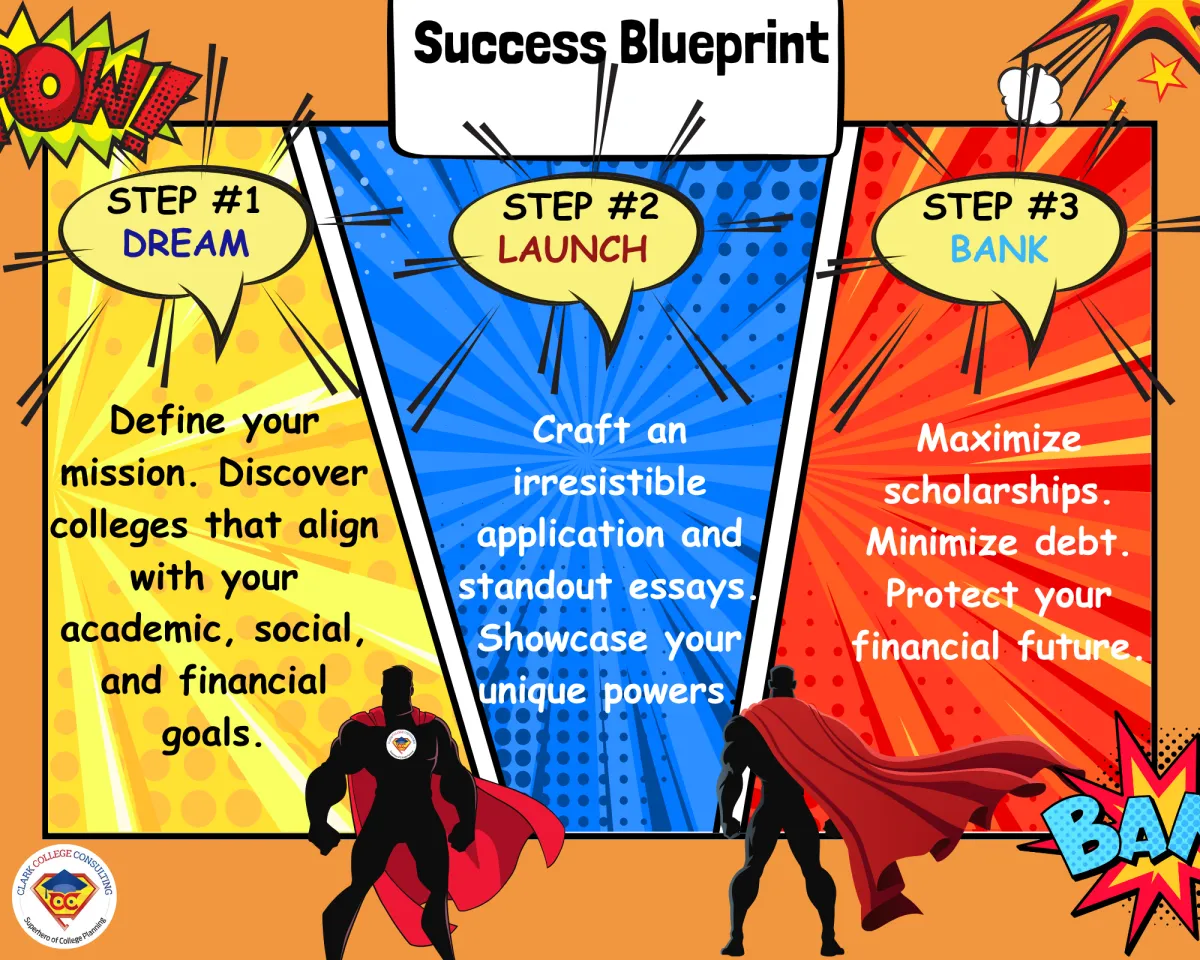

How Our Superhero Blueprint Saves the Day (and Your College Budget)

A 3-step strategy to transform stress into clarity and cost savings.

Want to Learn More About Our Blueprint?

Is Planning for College Your Kryptonite?

Imagine This...

You feel confident about your teen’s future.

They’re thriving at a college that fits

You didn’t have to drain your savings or take on crushing debt to make it happen.

That’s what we help families achieve every day.

What's at Stake?

Imagine spending tens of thousands more than you need to, only to watch your teen land at a college that doesn’t fit—academically, socially, or financially.

Without a clear plan, that’s the risk.

But with the right strategy, you become the hero of your family’s college journey—saving money, gaining peace of mind, and helping your teen launch with confidence.

Is This Right for You or Your Teen?

We get it. Without a strategic college admissions plan, families risk overpaying by tens of thousands, missing out on top-choice schools, and feeling constantly overwhelmed and behind schedule.

From confidence to cost savings — here’s how we’ve helped over 1,200 families and how we can help you too:

One-on-one guidance from 9th grade through senior year

Personalized planning aligned with your teen’s goals

Smart financial aid strategies save on average $40K–$60K+

Expertise that guarantees less stress, fewer mistakes, and better decisions

A clear roadmap so nothing falls through the cracks

You become the Superhero of your family!

Don't worry, we can help!

Start Your Teen’s Hero Journey

Just some of the colleges we’ve helps our students get into:

Victory Stories: Real Families. Real Results. Real Savings.

We’ve helped over 1,200 families get into best-fit colleges—

while saving $40K–$60K each and removing the stress from college planning.

🎓 Hannah Witner

Over $1M in Scholarship Offers | Wake Forest + UNC

✅ Accepted to all 10 schools she applied to

✅ Family saved $75,000

✅ Used DREAM, LAUNCH, BANK system from day one

🗣️ “What seemed impossible became real. We couldn’t have done this alone.”

—Thomas Witner, Dad

🎓 Jack Noone

$168,000 in Scholarships | Mercer + USC

✅ Scholarships & acceptances in 6-months

✅ Saved $96,000 in out-of-pocket costs

✅ College selection & essay coaching made the difference

🗣️ “We needed structure for such a big financial decision. Thanks to Ryan, Jack earned $168,000 in scholarships and landed at his top-choice school.”

— John Noone, Dad

🎓Shane M.

Accepted to All 6 Colleges | $120,000 in Scholarships

✅ Customized college list and financial aid strategy

✅ Essay coaching and timeline accountability

✅ Graduating with zero student loan debt

🗣️ “Ryan and his team walked us through every step. Shane got into all six schools—and won’t owe a penny when he graduates.”

— Mack McCormick, Dad & Retired Teacher

🎓 Maya E.

$35,000 in Scholarships | Dream College Acceptance

✅ Strategic application and timeline planning

✅ Custom tools and personal guidance

✅ Saved time, reduced stress,

🗣️ “Saved the day & made all the difference in the world. They got us organized, gave us the tools—and helped us earn $35,000 in scholarships.”

— Helen Emish, Mom

Getting Started Is Simple

1. Schedule a Free Strategy Call

We'll learn your family's goals and answer your biggest questions.

2. Get Your Personalized Plan

You’ll walk away with a step-by-step strategy for admissions + financial aid.

3. Move Forward with Confidence

We’ll guide you through the entire process—essays, deadlines, aid, and all.

Spots are limited. Let’s get your teen on track today:

Clarity

Straightforward advice.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Contact Us

Ryan Clark, MBA, CCPS | College Admissions & Affordability Advisor

Address: 10130 Mallard Creek Rd, Suite 300, Charlotte, N.C. 28262

Tel: 704-944-3543

Email: [email protected]

FOLLOW US

LEGAL

Helping Families Become the Heroes of Their College Journey.

© Copyright 2025. Charlotte, NC. All Rights Reserved.